2. Technical analysis of in vitro diagnostic industry

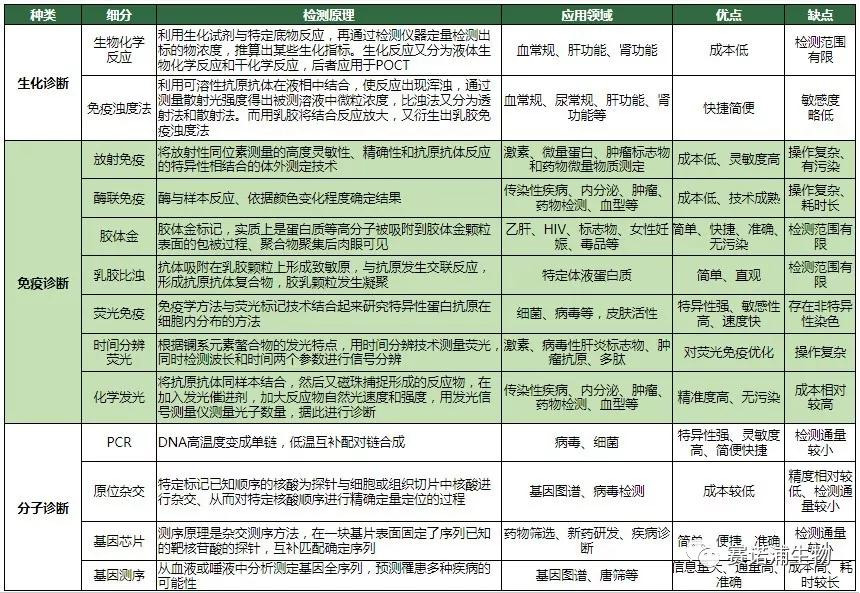

In vitro diagnosis is divided into three categories: biochemical diagnosis, immunodiagnosis, and molecular diagnosis according to methodological methods, as well as bedside rapid diagnosis POCT differentiated from biochemical, immunological and molecular diagnosis. The testing items mainly include hematology and flow cytometry, urine testing, tissue testing, microbial detection, tissue testing, elemental detection, and genetic testing.

1. Biochemical diagnosis is developed earlier in China. It is a routine diagnostic test project for hospitals. It focuses on disease monitoring that has already occurred. The growth rate is slower in the future, and the localization rate of reagents has reached more than 70%. Most of the instruments have also been localized. At present, domestically produced instruments only have a gap with foreign instruments in terms of instrument detection speed and integration.

2. Immunodiagnosis is the largest in vitro diagnostic sub-industry in China and is still in rapid development. High-end chemiluminescence has gradually replaced enzyme-linked immunoassay as the mainstream immunodiagnostic method in China, focusing on disease surveillance and market infection. The scale reaches more than 70% of the total market for immunodiagnosis. The low-end reagents and instruments are highly localized, but the high-end market such as tertiary hospitals is still monopolized by overseas giants. The import substitution of the high-end immunodiagnosis market in the future is the development direction.

3. Molecular diagnosis is in the early stage of development on a global scale, and has unique detection advantages for genetic diseases in the early stage of infection and possible occurrence.

2.1 Technical analysis

2.2 Detection principle and application field

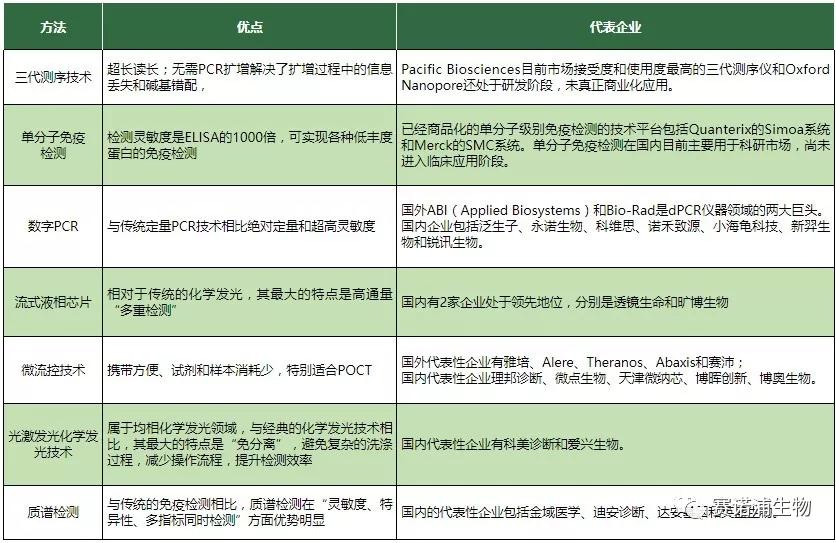

2.3 Innovative technologies

The field of IVD is an area that has always been innovative and has always had opportunities. All innovations are inseparable, and they are improving the precision, convenience and efficiency of testing, thus promoting the development of this field.

Detection accuracy: Accuracy includes specificity and sensitivity. The increase in specificity depends on the discovery of new indicators and the combination of multiple indicators (such as flow-based liquid crystal chips); the increase in sensitivity depends on innovations in signal systems and detection methods (eg, single-molecule detection technology, digital PCR technology);

Convenience of detection: Convenience includes convenience (convenience) and cheapness (profit). For basic hospitals, clinical departments, and individual households, the convenience of detection plays a decisive role. Some methods of POCT (such as microfluidic technology), while sacrificing a certain degree of precision, can greatly improve the convenience of detection. Sex

Detection efficiency: Improving detection efficiency is also one of the important development directions in the IVD field (such as homogeneous chemiluminescence technology to improve detection speed through no-clean, second-generation sequencing through high-throughput to significantly shorten sequencing time and automation operations, etc.).

In vitro diagnostic industry competition analysis

3. Competitive analysis

3.1 Competition pattern

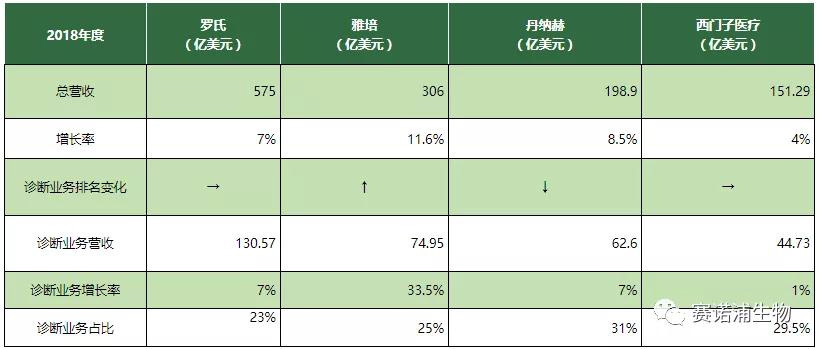

3.1.1 International competition pattern

In vitro diagnosis has become a mature industry with a huge market capacity of tens of billions of dollars on a global scale, and the market concentration is relatively high; it is mainly distributed in economic developed countries with early development and large capacity in the in vitro diagnostic market such as North America and Europe. Roche, Abbott, Beckman (Danaher), Siemens-based '4+X' is a relatively stable pattern. The top ten sales revenues of the industry are above $1 billion. The product line is rich, including not only various in vitro diagnostic reagents. It also includes a variety of diagnostic instruments and related medical technology services, and is highly competitive in their respective segments, accounting for 80% of the global market share.

Roche: Continue to be the leader in the industry with absolute advantage, and the diagnostic business revenue is almost the sum of the second and third.

Abbott: After the acquisition of Alere, it has become the world's second-largest IVD leader. Affected by this, the diagnostic business has a growth rate of 33.5%.

Danaher: Diagnostic business is the second largest business, reaching 31%. However, the sustained high growth rate declined in 2018.

Siemens Healthcare: After the IPO goes public, the annual target is completed in the first fiscal year. Adjusted diagnostic business revenue increased by 1% despite adverse exchange rates.

3.1.2 Domestic competition pattern

Overall, IVD companies grew steadily, and the operating income of 17 companies increased by more than 20% year-on-year. Among them, Sannuo Bio, Wanfu Bio, Celeste, Ji Egg Bio, and Bohui Innovation grew by more than 40%. Dean Diagnostics Dafa Medical, Antu Bio, Mike Bio, and Aide Bios have grown by more than 30%.

Among the 26 companies, only Daan Gene's business income has experienced negative growth, and Daan Gene is mainly engaged in the research, development and application of fluorescent PCR technology. The annual report shows that the original holding subsidiary Yunkang Health Industry Investment Co., Ltd. will no longer be included in the scope of consolidated statements in October 2018. In addition, the revenue and performance of its holding subsidiary Guangzhou Darui Biotechnology Co., Ltd. declined.

The net profit of Yangpu Medical in 2018 is -1.37 billion yuan. The main business of Yangpu Medical includes medical laboratory diagnosis and medical information construction. The market share of vacuum blood collection products reaches 10%, which is the leading enterprise in this field in China. According to the annual report, Yangpu Medical's 2018 annual provision for impairment of assets totaled 128 million yuan, an increase of nearly 100 million yuan over the same period of the previous year. Yangpu Medical explained that it mainly conducted a comprehensive inventory check and impairment test.

3.2 Characteristics of the competition pattern of domestic enterprises

The scale of production enterprises is small and the industry concentration is low. By the end of 2018, there are more than 1,000 in vitro diagnostic production enterprises in China, of which only 10 enterprises with an annual output value of more than 1 billion yuan. In 2018, Mindray Medical's in vitro diagnostic business with the highest market capitalization was 4.426 billion yuan, which is a huge gap with the international in vitro diagnostic leader Roche's $13 billion, Abbott's $7.5 billion, Danaher's $6.26 billion, and Siemens' $4.6 billion. Domestic enterprises started late, and there is still a big gap between them in terms of scale, strength, technology and innovation capabilities. Domestic enterprises are characterized by “small and scattered” and are mostly distributed in the low-end market.

The company's R&D investment is low and its innovation ability is weak. In 2018, the total operating income of 26 companies was 66.6 billion yuan, and the research and development investment was 4.8 billion yuan, accounting for 7.19%. It is the world's leading in vitro diagnostic company Roche (19% of R&D investment). Compared with China, the research and development investment in the in vitro diagnostic industry is obviously insufficient, and the ability of independent innovation is weak. And because international leading companies have formed a good brand effect in the early stage, there are certain barriers for domestic in vitro diagnostic products to enter large hospitals: First, there is a gap between the overall technical level and imports; second, some hospitals have a preconceived notion and believe that imports The test result of the product is superior to the domestic product.

Distribution is the mainstay, supplemented by direct sales; most IVD companies mainly rely on the distribution model, the company sells the products to the distributors, and then sells them to the end users by distributors, and obtains the increase of profits through the form of instrument sales of reagents. Molecular diagnostic companies such as Huada Gene, Aide Bio, and Cap Bio are at the forefront of the industry, focusing on academic promotion direct sales. With the policy orientation of the “two-vote system” of medical reform, the advantages of the direct sales model will increase in the future.

High technical barriers; in vitro diagnostic reagent industry is a combination of clinical laboratory science, biochemistry, molecular biology, organic chemistry, biomedical engineering and many other disciplines.

The barriers to market access are high; China implements a license management system for in vitro diagnostic products manufacturers, and the production enterprises must obtain the Medical Device Manufacturing Enterprise License and the Medical Device Management Enterprise License issued by the State Food and Drug Administration. The quality management system assessment, all listed products must also undergo clinical trials and obtain product registration certificates, and accept the supervision and management of relevant departments in the process of use.

3.3 Domestic enterprises compete in various segments

(1) Biochemical diagnosis market, market mature, performance decline

The technical threshold of biochemical diagnostic reagents is relatively low, there are many manufacturers, and the product homogeneity is serious. The compatibility of biochemical testing equipment is high, and the sales channel becomes the key to whether the product can enter the hospital market. As a result, the domestic biochemical diagnostic market is fiercely competitive. There is no absolute advantage for international brands, and the market share of some domestic brands is close to or catching up with international standards. Brand, the overall market structure is relatively scattered. In recent years, CFDA has increased the supervision of R&D, registration, production and sales of in vitro diagnostic products, and has improved the industry's entry threshold. Due to fierce market competition, enterprises with scale and cost advantages have seized the market through price cuts, resulting in a decline in the gross profit margin of the industry. The pressure on small and medium-sized manufacturers has increased sharply, and the market concentration in the future is expected to further increase.

(2) Immunodiagnostic market, the main field of import substitution Chemiluminescence immunoassay technology has extremely high detection accuracy and sensitivity. It is the mainstream technology in the immunodiagnosis market. Due to its high technical threshold, it is difficult to develop, with Roche, Abbott and Dan. International giants such as Nach and Siemens have basically monopolized domestic and foreign markets. The domestic immunodiagnosis market has a high concentration, and imported manufacturers account for 90% of the market. In recent years, domestic brands have begun to rise, and more than 50 domestic manufacturers have obtained chemiluminescence registration certificates. Among them, Shenzhen New Industry, Zhengzhou Antu, Sichuan Mike and Shenzhen Mindray have sales exceeding 100 million. Since the chemical luminescence instruments and reagents on the market are basically closed systems, manufacturers generally drive the sales of reagents by means of placing instruments, and companies that can independently produce instruments will gain a large first-mover advantage. Companies that typically produce their own instruments need to have both enzyme-linked immunosorbent and chemiluminescent technologies, as well as software and hardware system integration techniques. Since a variety of test items can be detected on one instrument, the variety of reagents will greatly enhance the competitiveness of the instrument and form a virtuous circle.

(3) Molecular diagnostic market, the most subjective area of capital concern

At present, molecular diagnostics has developed rapidly in the world. Domestic enterprises and foreign leading enterprises are in a synchronous development period. Their technologies are mainly used in infectious disease detection, tumor detection, prenatal and genetic disease detection. From a global perspective, Roche, Novartis, Abbott and other international giants lead the field of molecular diagnostics. The world's top eight companies account for 88% of the market share, and the market concentration is quite high. Among them, Roche is the world's largest molecular diagnostic company. Molecular diagnostic technology is at the forefront of life sciences and has high technical threshold. At present, it has accumulated certain technologies in the fields of PCR, gene chip and gene sequencing, and there is still much research space in microfluidics and flux detection in the future.

(4) POCT market, the fastest growing revenue field

The concentration of POCT in China is relatively low. The three international giants of Roche, Johnson & Johnson and Abbott account for 47% of the market. The domestic market share of POCT leading companies such as Wanfu and Jifei Bio is less than 10% in the domestic market. The share is below 5%.

In vitro diagnostic industry investment situation

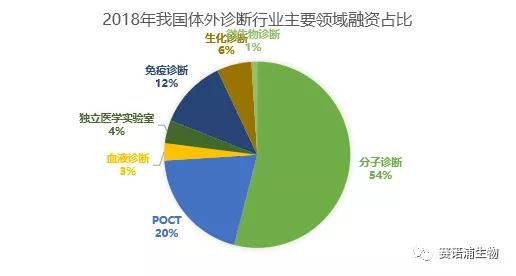

4. In vitro diagnostic industry investment situation

From the perspective of the capital market, since 2014, the scale of financing for the in vitro diagnostic industry has started to increase substantially. In the case of a bad market environment in 2017 and 2018, it has also obtained a financing scale of more than 5 billion.

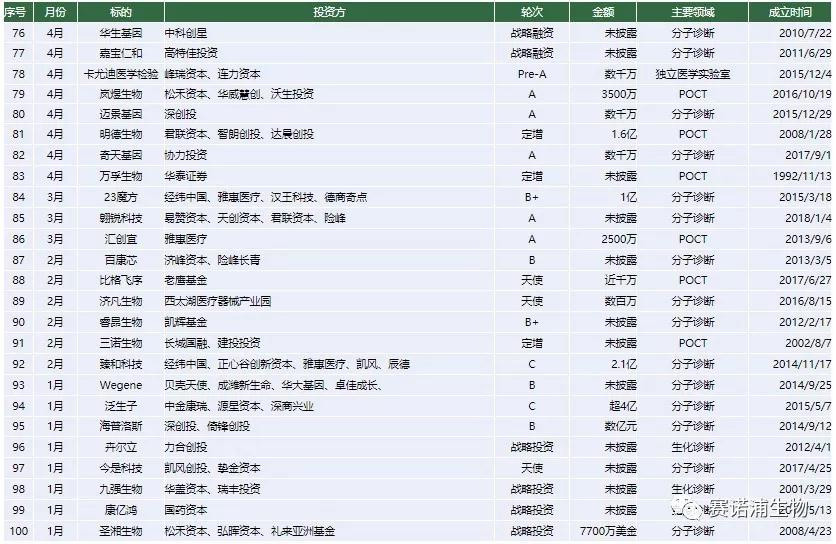

In 2018, there were 100 financing events in the entire industry, and the amount disclosed publicly was as high as 7 billion yuan, up 31.16% from 2017.

The early financing companies (Angel-B round) accounted for the most, accounting for 49%. The basic product model of such enterprises has been verified, and the enterprises are relatively stable, requiring capital to continue to expand.

Strategic financing enterprises account for 20%. Strategic financing refers to capital expenditures that have long-term impact on the future of the enterprise. It has large scale, long cycle, long-term goals based on enterprise development, and phased characteristics, which have a major impact on the overall situation of the enterprise.

Private placements account for 11%. Such investments are generally applicable to listed companies. They are a form of private equity financing that involves a small scope and allows companies to obtain the funds or assets needed for development in a relatively short period of time.

From the perspective of different technical fields of in vitro diagnosis, molecular diagnosis and POCT are still hot spots for investment, and have become the most promising sub-field after the mainstream fields such as biochemical diagnosis and immunodiagnosis. In particular, molecular diagnostics accounted for 54% of the annual financing events, more than half of the share. Among them, tumor diagnosis, early tumor screening and consumer-grade genetic testing services are favored by capital, and investment institutions are more optimistic about technology-leading companies.

All 14 companies have successfully financed within less than one year of establishment. In addition to the company's main focus on POCT, other companies have entered the field of molecular diagnostics. Among them, Qiu Medical received nearly 250 million yuan of investment in two months, seeking medical science to focus on the field of tumor liquid biopsy, and established China's first tumor special inspection chain laboratory.

5. In vitro diagnostic industry development trends and investment opportunities

5.1 Industry development trend

standardization

With the continuous deepening of the national medical reform and the gradual improvement of the testing standardization, the mutual recognition test results of medical institutions are an inevitable trend. By verifying the entire inspection system, including controls, reagents, instruments, personnel, and operational procedures, it provides important support for the accuracy of the test results, so that the test results can be traced back to the most internationally recognized certified reference materials, which is a medical test. An important way of standardization. Whether a standard quality system can be established in the future will become an important competitive advantage for in vitro diagnostic companies.

System closed

The bundled sales of instruments and reagents has become the mainstream sales model of domestic in vitro diagnostic companies. Due to the wide variety of in vitro diagnostic products, hospitals as the main channel for sales of in vitro diagnostic reagents have a strong position in the bidding. In order to obtain hospital channels, in vitro diagnostic products companies often send inspection instruments to hospitals free of charge, and agree that the hospitals are within a certain period of time ( Usually 5 years) Purchasing the company's corresponding reagents, through this bundled sales to achieve product sales in the hospital. With the increasing requirements for precision in in vitro diagnostics, the professional enhancement of instruments and reagents, and the drive for companies to obtain more profit margins, in vitro diagnostic instruments and reagents form a closed system that will become an important trend in the future.

Sales mode of integrated mining and comprehensive services

The hospital reduces costs through centralized procurement. Achieve win-win. The sales of in vitro diagnostic instruments not only need to be installed and debugged, but also require continuous maintenance in the later stage. However, due to the limitation of the warranty period, the reagents have high requirements for cold chain transportation and inventory management, and the limited warehouse area of the hospital cannot store sufficient inventory. The revolving efficiency of the reagents is very high. Therefore, if the corresponding value-added services are further provided under the premise of providing the instruments and reagents for sale, the hospital approval can be maximized, thereby further increasing customer stickiness.

M&A and restructuring + expanding the industrial chain

In the development process of enterprises, endogenous growth and external mergers and acquisitions are important growth paths. Due to the large number of domestic in-vitro diagnostic sub-sectors, although the rapid growth, but the scale is still relatively limited in the short-term, and each sub-sector has fierce competition from domestic and foreign manufacturers, it is difficult to obtain absolute market share in a sub-sector. Therefore, active vertical expansion and horizontal merger can enable enterprises to obtain multiple growth points and become an important choice for the continuous development of enterprises. For example, Wanfu Bio (300482.SZ) is mainly engaged in the R&D, production and sales of POCT related products such as rapid diagnostic reagents and rapid testing instruments. It is one of the leading enterprises in the domestic POCT industry. The company has a total of 21 subsidiaries, including 16 sales channel companies. It covers North China, Southwest China, South China, Northwest China and East China in the domestic market. Through continuous mergers and acquisitions, the company gradually forms upstream products, midstream channels and downstream testing services. The entire industry chain layout.

5.2 Industry Investment Opportunities

(1) Innovative research and development capabilities

The IVD industry is a multi-disciplinary integrated application with a high technology density in the sunrise industry. Its core value is to obtain sample clinical test indicators accurately, quickly, efficiently and at low cost. Innovative research and development to promote technological progress can enhance the core competitiveness of enterprises.

(2) Product line

In clinical practice, there are many in vitro testing items, the principle of single testing items is different, and the price difference is large. When purchasing downstream customers, they often need to face many suppliers. For the purpose of convenient management, they hope to control the supply. Number of businesses. With the gradual promotion of the centralized procurement model, the products-rich manufacturers have more advantages in the collection and procurement of tenders.

(3) Marketing ability

Due to the wide geographical distribution of in vitro diagnostic customers, the single customer's small purchase volume and strong product professionalism, it has a good market development capability and professional service capability, and a wide coverage of the marketing network is conducive to the rapid occupation of the market.

(4) Financial strength

Diagnostic reagents and instruments have a long development cycle and a large investment. The “instrument+reagent” linkage marketing model often has a long payback period and requires enterprises to have strong financial capabilities.